Showing posts with label DX. Show all posts

Showing posts with label DX. Show all posts

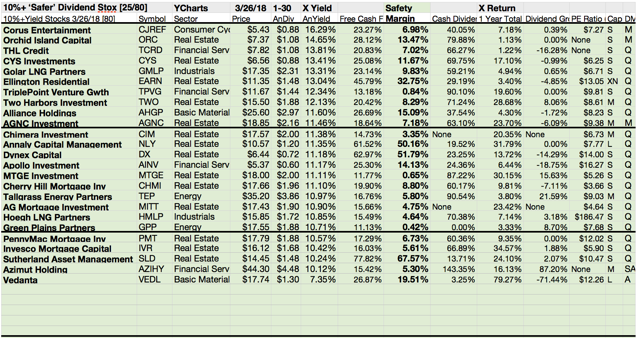

4 Dividend Payer With 10% Yields And Promising Fundamentals

Big dividends are dead? No, I don't

think so. Despite the fact that the FED and other national banks killed the

interest rates, there are still high and stable dividend payments.

Today I like to

focus my thoughts on higher risk stocks with bigger dividends. Those stocks

have a really low market capitalization, a high payout ratio and cheap valuation.

As a result, dividend yield ratios explode. Attached is a list of the top 20 results by yield who met my criteria.

As a result, dividend yield ratios explode. Attached is a list of the top 20 results by yield who met my criteria.

These are my

criteria in detail:

- Market Cap over

$300 million

- Positive 5Y

Earnings Growth Forecast

- Low Forward P/E

- Debt/Equity

under 0.5

- Buy Rating from

Analysts

These are the 5

top yielding results...

Labels:

AI,

Cheap Stock,

CYS,

Debt Ratio,

Dividends,

DX,

Growth,

High Yield,

Midcaps,

PMT,

PZN,

Small Cap,

VIV

Ex-Dividend Stocks: Best Dividend Paying Shares On October 03, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 18 stocks go ex dividend

- of which 7 yield more than 3 percent. Here is a full list of all stocks with ex-dividend

date within the current week.

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

Dynex

Capital Inc.

|

490.92M

|

5.76

|

0.99

|

3.87

|

12.09%

|

|

|

Brookfield Renewable Energy Partners

|

7.01B

|

-

|

2.35

|

5.27

|

5.43%

|

|

|

The

First Bancorp, Inc.

|

176.78M

|

14.12

|

1.21

|

3.53

|

4.68%

|

|

|

Banco

Santander (Brasil) S.A.

|

-

|

691.00

|

40.65

|

-

|

4.05%

|

|

|

Ennis

Inc.

|

471.40M

|

14.93

|

1.26

|

0.90

|

3.88%

|

|

|

The Bank of South Carolina

|

63.87M

|

16.31

|

1.86

|

5.07

|

3.34%

|

|

|

Golden

Enterprises Inc.

|

46.93M

|

40.00

|

1.95

|

0.34

|

3.25%

|

|

|

Terreno

Realty Corp.

|

338.24M

|

-

|

1.14

|

8.76

|

2.93%

|

|

|

U.S. Global Investors, Inc.

|

42.89M

|

-

|

1.16

|

2.29

|

2.17%

|

|

|

McCormick

& Co. Inc.

|

8.57B

|

21.34

|

4.81

|

2.09

|

2.10%

|

|

|

Banner

Corporation

|

744.13M

|

14.36

|

1.43

|

4.07

|

1.25%

|

|

|

Tootsie

Roll Industries Inc.

|

1.86B

|

35.40

|

2.88

|

3.42

|

1.03%

|

|

|

First

Internet Bancorp

|

75.06M

|

11.65

|

1.23

|

3.13

|

0.92%

|

|

|

Shoe

Carnival Inc.

|

538.67M

|

17.89

|

1.76

|

0.60

|

0.89%

|

|

|

Curtiss-Wright

Corp.

|

2.22B

|

21.68

|

1.61

|

0.97

|

0.84%

|

|

|

Werner

Enterprises Inc.

|

1.73B

|

18.55

|

2.35

|

0.86

|

0.84%

|

|

|

Limoneira

Company

|

342.68M

|

64.38

|

3.75

|

4.01

|

0.58%

|

|

|

Eagle

Materials Inc.

|

3.62B

|

48.61

|

4.99

|

5.06

|

0.54%

|

12 Dividend Income Growth Stocks Below Book Value

Dividend

growth stocks below book value originally published at long-term-investments.blogspot.com. How would it be if you

purchase a dollar for 50 cents? I believe it would a great deal but who gives

you values for less than the price you pay?

For sure, nobody will gift you something on the market and there is definitely no free lunch. That’s a major rule I’ve learned from my years as a professional investor. But sometimes these are good companies with price to book ratios below the current market valuation. Theoretically, you get more values for each dollar but does it helps you if the corporate produces losses and decreases the book value year for year? I don’t think so. But the answer is always hidden.

Today I would like to present you dividend growth stocks that have hiked their payments uninterrupted over more than five years and have a price-to-book ratio below one at the same time. The financial industry is one of the biggest contributors to the screening results. Are there real values for investors?

Only 12 corporate stocks in total fulfilled these two criteria of which four yield over three percent and six of them have a current buy or better rating.

For sure, nobody will gift you something on the market and there is definitely no free lunch. That’s a major rule I’ve learned from my years as a professional investor. But sometimes these are good companies with price to book ratios below the current market valuation. Theoretically, you get more values for each dollar but does it helps you if the corporate produces losses and decreases the book value year for year? I don’t think so. But the answer is always hidden.

Today I would like to present you dividend growth stocks that have hiked their payments uninterrupted over more than five years and have a price-to-book ratio below one at the same time. The financial industry is one of the biggest contributors to the screening results. Are there real values for investors?

Only 12 corporate stocks in total fulfilled these two criteria of which four yield over three percent and six of them have a current buy or better rating.

Ex-Dividend Stocks: Best Dividend Paying Shares On March 27, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks March 27,

2013. In total, 28 stocks and

preferred shares go ex dividend - of which 10 yield more than 3 percent. The

average yield amounts to 4.51%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Dynex

Capital Inc.

|

591.76M

|

8.08

|

0.96

|

5.21

|

10.63%

|

|

Spirit

Realty Capital, Inc

|

1.63B

|

-

|

1.30

|

5.75

|

6.52%

|

|

Realty

Income Corp.

|

8.57B

|

58.17

|

2.45

|

18.03

|

4.91%

|

|

Liberty

Property Trust

|

4.75B

|

37.82

|

2.25

|

6.93

|

4.78%

|

|

Hersha

Hospitality Trust

|

1.16B

|

-

|

1.40

|

3.23

|

4.12%

|

|

CBL

& Associates Properties

|

3.81B

|

35.22

|

2.87

|

3.68

|

3.90%

|

|

Prudential

plc

|

41.98B

|

12.48

|

2.68

|

0.50

|

3.81%

|

|

Maiden

Holdings, Ltd.

|

770.55M

|

16.89

|

0.76

|

0.41

|

3.38%

|

|

BankUnited,

Inc.

|

2.66B

|

12.62

|

1.36

|

3.69

|

3.25%

|

|

Republic

Services, Inc.

|

11.84B

|

21.06

|

1.53

|

1.46

|

2.88%

|

|

CubeSmart

|

2.11B

|

-

|

2.10

|

7.45

|

2.79%

|

|

Cardinal

Health, Inc.

|

14.33B

|

12.74

|

2.19

|

0.14

|

2.62%

|

|

Pebblebrook

Hotel Trust

|

1.55B

|

210.00

|

1.17

|

4.07

|

2.54%

|

|

Dell

Inc.

|

25.35B

|

10.75

|

2.36

|

0.45

|

2.21%

|

|

ProAssurance

Corporation

|

2.87B

|

10.48

|

1.27

|

4.02

|

2.14%

|

|

International

Bancshares

|

1.39B

|

14.85

|

0.97

|

3.69

|

1.94%

|

|

State

Street Corp.

|

27.10B

|

14.19

|

1.30

|

8.99

|

1.75%

|

|

Mondelez

International, Inc.

|

53.14B

|

34.74

|

1.65

|

1.52

|

1.74%

|

|

AmTrust

Financial Services, Inc.

|

2.34B

|

12.70

|

2.05

|

1.25

|

1.61%

|

|

HCC

Insurance Holdings Inc.

|

4.18B

|

10.85

|

1.18

|

1.65

|

1.59%

|

Subscribe to:

Posts (Atom)