Showing posts with label LHO. Show all posts

Showing posts with label LHO. Show all posts

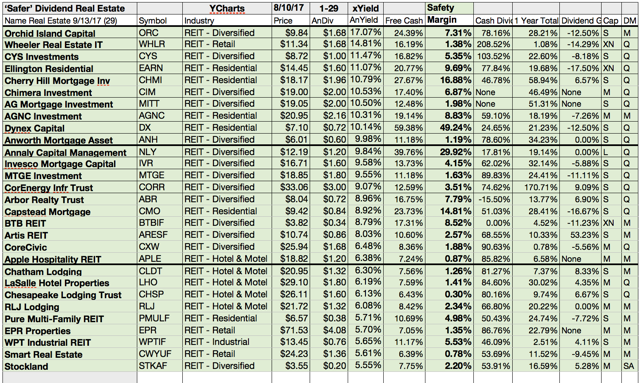

33 Safe High-Yield S&P 500 Stocks

Dividend-paying stocks that have gotten left behind in the rally now feature higher dividend yields, which may be attractive to investors.

But buyer beware: Many yields are high because some investors fear the stocks. But if you do extra research on specific companies and reach a certain comfort level, you may be looking at some bargains.

Long-time income investors are constantly facing the problem of how to replace income lost when older and higher-yielding bonds and callable preferred stocks are redeemed. And more than eight years into the bull market, while interest rates are still historically low, the problem keeps getting worse.

We have featured the S&P High-Yield Dividend Aristocrats, which are companies included in the S&P 1500 Composite Index that have raised dividends for at least 20 consecutive years.

But many have yields that aren’t attractive.

We also put together a list of dividend stocks culled with rather stringent criteria for free cash flow and sales growth. This time around, we are taking a far less stringent approach.

A total of 33 companies among the S&P 1500 met these criteria:

• Dividend yields of at least 5%.

• No cuts of regular dividends over the past five years

• A free cash flow yield, for the past 12 months, exceeding the current dividend yield.

These are the results...

But buyer beware: Many yields are high because some investors fear the stocks. But if you do extra research on specific companies and reach a certain comfort level, you may be looking at some bargains.

Long-time income investors are constantly facing the problem of how to replace income lost when older and higher-yielding bonds and callable preferred stocks are redeemed. And more than eight years into the bull market, while interest rates are still historically low, the problem keeps getting worse.

We have featured the S&P High-Yield Dividend Aristocrats, which are companies included in the S&P 1500 Composite Index that have raised dividends for at least 20 consecutive years.

But many have yields that aren’t attractive.

We also put together a list of dividend stocks culled with rather stringent criteria for free cash flow and sales growth. This time around, we are taking a far less stringent approach.

A total of 33 companies among the S&P 1500 met these criteria:

• Dividend yields of at least 5%.

• No cuts of regular dividends over the past five years

• A free cash flow yield, for the past 12 months, exceeding the current dividend yield.

These are the results...

15 REITs With FFO Yields Over Dividend Yield

FFO is meant to provide the best measurement of a REIT’s cash flow available for dividend payments.

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

If you are thinking about a REIT purchase, you need to consider the company’s ability to maintain or raise its dividend, because a dividend cut could hurt the stock price terribly, and income is your main objective.

There are 92 REITs in the S&P 1500 Composite Index and some of them still have room to grow dividend payments. Here are the 15 with the highest dividend yields that also have “headroom” to raise dividends:

16 High-Yield Dividend Growth Stocks Good Enough To Buy

Just because a stock pays a high dividend doesn't necessarily make it a good long-term investment. But it could make sense to put small amounts of money into high yielding stocks in order to boost your dividend income.

Attached you will find a compilation of stocks with high-yields that might boost your portfolio cash income in the futre. I hope you will find some new ideas on the list. Do you like any of them or do you still own a few of the selected stocks?

Here are a few great long-term investments with yields above 5%...

12 Stocks That Might Get A Boost Indirectly From Low Energy Prices

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

Crude oil’s crash may have roiled

stocks to start 2016, but cheap fuel is actually a great thing for the average

American. Consumer confidence is heading higher, thanks to low gas prices and a

continually improving job market.

In general, it

should be good the US economy to have a low oil price. The states are net

import of oil. The cheaper the oil price, the cheaper the energy bill of the

USA.

A negative impact

is expected from the oil and gas industry, especially from own energy companies

like Chevron, Exxon Mobil. A hard environment has share fracker and oil

equipment firms.

Also headwinds

faced by banks with a big loan portfolio related to the energy sector.

Today I would like

to introduce some stocks that might get some backwinds from the low oil price.

It's not only the consumer. Many energy consumption stocks like manufacturer,

travel stocks, airlines could also improve margins due to lower energy costs.

Here are 12 higher yielding stocks that are directly benefiting from more leisure travel. They’re all

on sale at the moment, too.

Here are the results...

Here are the results...

40 Highest Yielding Ex-Dividend Stocks Of The Coming Week

Here I share all higher capitalized stocks going ex-dividend next week. A huge number of stocks plan to go ex-dividend, in total 271 dividend stocks. 132 of them are capitalized over 2 billion. Attached you can find those stocks with the highest payment

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

A full list of next weeks ex-dividend stocks can be found here: Ex-Dividend Stocks Of The Next Week Sep. 28 – Oct. 04, 2015.

If we focus more on cheap stocks than on high yields, Dow Chemical, Toronto-Dominion Bank, Nucor, Agrium, Cisco, Steel Dynamics, PG&E, are the top picks. Not included are REITs. Those pay typically high dividends but offer also huge debt burdens.

8 Value Stocks With Enormous Dividend Yields

Many investors like to watch the dividend yield, which is calculated as the annual dividend income per share divided by the current share price. I do it daily and screen the market by the highest yielding and most attractive stocks.

I also look for smaller companies and stocks that pay only a small part of its annual income. The idea behind is that growth can boost your future dividend yield.

The dividend yield measures the amount of income received in proportion to the share price. To use the ratio is an easy way to compare the relative attractiveness of various dividend-paying stocks. It tells an investor the yield he/she can expect by purchasing a stock.

Today I like to focus on value stocks with high yields. Attached are 8 ideas that pay enormous dividends while having deep values.

These are the results:

I also look for smaller companies and stocks that pay only a small part of its annual income. The idea behind is that growth can boost your future dividend yield.

The dividend yield measures the amount of income received in proportion to the share price. To use the ratio is an easy way to compare the relative attractiveness of various dividend-paying stocks. It tells an investor the yield he/she can expect by purchasing a stock.

Today I like to focus on value stocks with high yields. Attached are 8 ideas that pay enormous dividends while having deep values.

The Latest Dividend Growth Stocks | Kinder Morgan In Focus

Stocks with receent dividend hikes originally published at long-term-investments.blogspot.com.

Two initial special dividends were announced yesterday and nine companies announced a nice dividend growth on the past trading day.

The biggest stock was Kinder Morgan Partners and the greatest dividend hike came from Western Refining with a 50 percent dividend growth. See the table below with ex-dividend and payment dates.

Dividend growth accelerates but is still weak.

Company

|

Dividend Yield in %

|

Dividend Growth

|

Payment Period

|

Ex-Dividend Date

|

Dividend Payment Date

|

Boston Priv Fincl Hldgs

|

2.47

|

40.00%

|

Quarterly

|

8/6/2013

|

8/22/2013

|

EQT Midstream Partners LP

|

3.50

|

8.11%

|

Quarterly

|

8/1/2013

|

8/14/2013

|

First Community

|

2.15

|

20.00%

|

Quarterly

|

7/29/2013

|

8/15/2013

|

Kinder Morgan

|

4.05

|

5.26%

|

Quarterly

|

7/29/2013

|

8/15/2013

|

Kinder Morgan Energy

|

6.17

|

1.54%

|

Quarterly

|

7/29/2013

|

8/14/2013

|

LaSalle Hotel Prprts

|

4.23

|

40.00%

|

Quarterly

|

9/26/2013

|

10/15/2013

|

Western Gas Equity Ptrs

|

1.88

|

10.49%

|

Quarterly

|

7/29/2013

|

8/21/2013

|

Western Gas Partners LP

|

3.57

|

3.70%

|

Quarterly

|

7/29/2013

|

8/12/2013

|

Western Refining

|

2.63

|

50.00%

|

Quarterly

|

7/29/2013

|

8/15/2013

|

Labels:

BPFH,

Dividend Growth,

Dividends,

EQM,

Ex-Div Date,

FCCO,

KMI,

KMP,

LHO,

Oil and Gas,

Pipelines,

WES,

WGP,

WNR

Stocks With Fastest Dividend Growth In April 2012

Shares

With Highest Dividend Growth by Dividend Yield – Stock, Capital, Investment. Here is a current sheet

of companies with fastest dividend growth compared to the previous dividend

declaration. The dividend growth is often a good indicator for the financial

health of a stock. Companies with a strong increase in dividends judge the future

of their company rosy and they want to give money back to shareholders that they don’t

need for their business.

In total, 49 companies announced a dividend growth of more than 10 percent within the recent month. The

average dividend yield of the fastest dividend growth stocks from last month amounts

to 3.37 percent and the dividend growth is 70.76 percent.

The Best Stocks With Dividend Growth From Last Week (April 16 – April 22, 2012)

Stocks With Biggest Dividend Hikes From Last Week by Dividend Yield – Stock, Capital, Investment. Here is a current sheet of companies that have announced a dividend increase within the recent week. In total, 42 stocks and funds raised dividends of which fifteen have a dividend growth of more than 10 percent. The average dividend growth amounts to 20.10 percent. Fourteen stocks have a yield over five percent and all nineteen are currently recommended to buy.

Subscribe to:

Posts (Atom)