When the price of a dividend stock climbs, its yield falls. As a result, a rising stock market, such as we've had of late, can make it harder for income investors to find attractive dividend payers.

Indeed, the current dividend yield on Standard & Poor's 500-stock index is just 2.1%, down from 2.3% a year ago. For retirees dependent on investment income, a 2.1% yield won't even keep up with inflation in 2017.

True, investors can buy stocks with unusually high yields, but such names typically come with greater risks. A too-good-to-be-true yield can be a red flag about a company's financial health and an indicator that the dividend isn't sustainable.

That's why dependable, high-quality stocks with above-average dividend yields are such important components of a retirement portfolio. Here are four great dividend stocks that are paying double the yield of the blue-chip S&P 500 index.

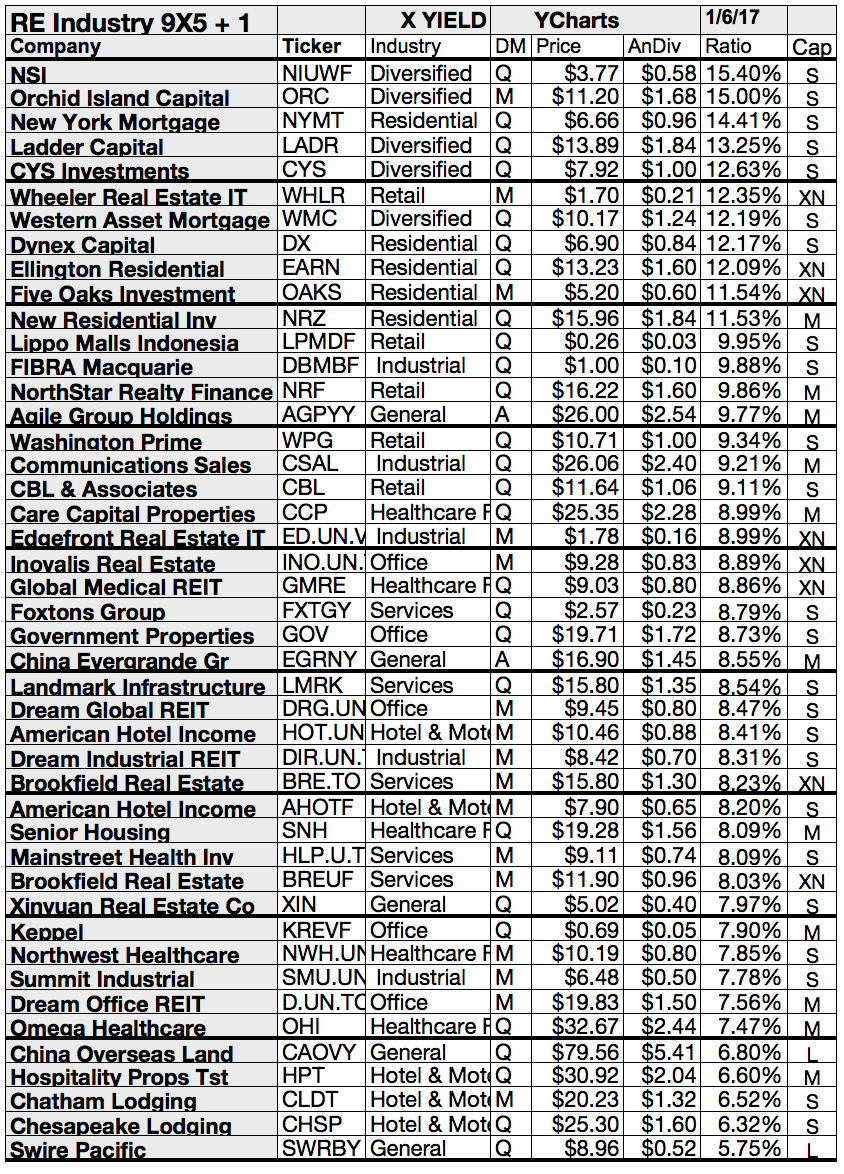

Attached, we've tried to compile a couple of stocks which combines both, a high yield, growth and some kind of safeness.

These are the results...

5 Safe Dividend Stocks To Consider Now

With interest rates sitting near record lows, the stock market hitting all-time highs, and global growth remaining sluggish, many conservative investors seeking safe retirement income are anxious.

Dividend stocks have been a popular place to hunt for retirement income because they offer yields higher than Treasuries and provide the potential for income growth and capital appreciation.

However, not all dividend stocks are safe -- especially those with high yields and risky fundamentals.

But what should you add to your portfolio this year? Dividend stocks are good -- and often safe -- places for your cash.

Here are a few diverse industrial companies to consider investing in for 2017. Each not only pays a solid dividend, but also anticipates a strong year ahead, which could lead to share price appreciation as well.

These are the results...

Dividend stocks have been a popular place to hunt for retirement income because they offer yields higher than Treasuries and provide the potential for income growth and capital appreciation.

However, not all dividend stocks are safe -- especially those with high yields and risky fundamentals.

But what should you add to your portfolio this year? Dividend stocks are good -- and often safe -- places for your cash.

Here are a few diverse industrial companies to consider investing in for 2017. Each not only pays a solid dividend, but also anticipates a strong year ahead, which could lead to share price appreciation as well.

These are the results...

5 Interesting Stocks For Income Investors With a Long Investment Horizon

Whether it’s your first, second, or third year reading my annual dividend stock picks, I’m excited to share my top retirement income picks for 2017. My theme for the year is “Stay in your lane and go with what you know.” It serves as a reminder that despite all the hoopla going on in the markets since the presidential election, the key to investing success is staying disciplined.

However, staying disciplined isn’t as easy as many investors expect. Simply because, different styles and approaches can ebb and flow with the markets direction.

This became evident late last year when interest rates shot through the roof. In less than three months, the 10-year US treasury jumped almost 1%, pushing down many of popular dividend paying stocks. For conservative investors who enjoy the income from stocks sectors like utilities, REITs, MLPs, and even boring consumer defensive stocks, 2017 couldn’t come fast enough.

As a result, many income oriented investors and retirees saw their portfolio’s flat-line despite the Dow and other major indices hitting new all-time highs.

That being said, I don’t think investors should flee from these sectors. While a new administration and Republican Congress might signal changes ahead, the election results have not diminished their long-term brand positioning, cash flow, or ability to make good on their dividends payments.

Attached you will find a couple of stocks that might be interesting for income investors with a long investment horizon.

These are the results...

However, staying disciplined isn’t as easy as many investors expect. Simply because, different styles and approaches can ebb and flow with the markets direction.

This became evident late last year when interest rates shot through the roof. In less than three months, the 10-year US treasury jumped almost 1%, pushing down many of popular dividend paying stocks. For conservative investors who enjoy the income from stocks sectors like utilities, REITs, MLPs, and even boring consumer defensive stocks, 2017 couldn’t come fast enough.

As a result, many income oriented investors and retirees saw their portfolio’s flat-line despite the Dow and other major indices hitting new all-time highs.

That being said, I don’t think investors should flee from these sectors. While a new administration and Republican Congress might signal changes ahead, the election results have not diminished their long-term brand positioning, cash flow, or ability to make good on their dividends payments.

Attached you will find a couple of stocks that might be interesting for income investors with a long investment horizon.

These are the results...

16 High-Yield Dividend Growth Stocks

More often than not, dividend stocks are what form the foundation of any great retirement portfolio. Not only have dividend stocks handily outperformed non-dividend-paying stocks over the long run, but they also offer a number of other advantages that income investors are bound to like.

To begin with, dividend-paying companies often have time-tested business models. A business is unlikely to pay a recurring dividend to investors if its management team didn't believe profits would grow in the future. Thus, dividend stocks are often a beacon of profitability and stability that attract income seekers.

Dividend stocks also help to hedge against inevitable stock market corrections -- there have been 35 stock market corrections of at least 10% since 1950 in the S&P 500 -- and payouts can be reinvested back into more shares of stock via a Dividend Reinvestment Plan, or DRIP. Purchasing more shares of dividend-paying stock with your payout in a repeating cycle can help your nest egg quickly compound in value over time.

Unfortunately, dividend stocks can also harbor a dark side. Income seekers would like the highest dividend yield possible, but they also have to ensure that a payout is sustainable. Dividend yields are a function of a stock's price, meaning a plunging stock price can dramatically lift dividend yields, making them seem attractive, at least on the surface. But, as we know, a plunging stock price could signify a business model that's in trouble. Thus, high-yield dividends, or those with yields of 4% or higher, should be heavily scrutinized by investors.

The yields on dividend stocks rise when their share prices become depressed. That’s an opportunity to chase extra yield. Besides, the best dividend-paying stocks do their most good when they are held for long periods of time. Ideally, the holding period includes many dividend hikes and market cycles.

In the beginning of this New Year, many investors review their portfolios. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio. I selected some high yielding long term dividend growth stocks I think will perform well in 2017 and will increase their dividend payouts.

These are the results...

To begin with, dividend-paying companies often have time-tested business models. A business is unlikely to pay a recurring dividend to investors if its management team didn't believe profits would grow in the future. Thus, dividend stocks are often a beacon of profitability and stability that attract income seekers.

Dividend stocks also help to hedge against inevitable stock market corrections -- there have been 35 stock market corrections of at least 10% since 1950 in the S&P 500 -- and payouts can be reinvested back into more shares of stock via a Dividend Reinvestment Plan, or DRIP. Purchasing more shares of dividend-paying stock with your payout in a repeating cycle can help your nest egg quickly compound in value over time.

Unfortunately, dividend stocks can also harbor a dark side. Income seekers would like the highest dividend yield possible, but they also have to ensure that a payout is sustainable. Dividend yields are a function of a stock's price, meaning a plunging stock price can dramatically lift dividend yields, making them seem attractive, at least on the surface. But, as we know, a plunging stock price could signify a business model that's in trouble. Thus, high-yield dividends, or those with yields of 4% or higher, should be heavily scrutinized by investors.

The yields on dividend stocks rise when their share prices become depressed. That’s an opportunity to chase extra yield. Besides, the best dividend-paying stocks do their most good when they are held for long periods of time. Ideally, the holding period includes many dividend hikes and market cycles.

In the beginning of this New Year, many investors review their portfolios. We all hope for a good year on the market and, most importantly, steady dividend growth increase among our portfolio. I selected some high yielding long term dividend growth stocks I think will perform well in 2017 and will increase their dividend payouts.

These are the results...

Subscribe to:

Posts (Atom)